43 how to determine coupon rate

How to Calculate the Yield of a Zero Coupon Bond Using ... That's gonna allow us to calculate just that so let's jump into an example and I'll show you how it works. So let's say that you didn't know the yield on a five-year zero-coupon bond but you did know the forward rates here I've got the forward rates for the next five years so you've got these different forward rates here and you can essentially just plug them into this formula above and we can ... › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

What Is Coupon Rate and How Do You Calculate It ... A coupon rate is the yield paid by a fixed-revenue safety; a fixed-income safety's coupon price is simply just the annual coupon funds paid by the issuer relative to the bond's face or par value. The coupon rate, or coupon payment, is the yield the bond paid on its concern date. This yield modifications as the worth of the bond ...

How to determine coupon rate

How do you calculate the PMT of a bond? - FindAnyAnswer.com Multiply the bond's coupon rate by its par value to determine its annual interest. In this example, multiply 5 percent, or 0.05, by $1,000 to get $50 in annual interest. Divide the bond's annual interest by its price to convert the price to a yield. In this example, divide $50 by $1,048.90 to get 0.0477. Yield Calculation for a 10-Year Treasury Note - sapling When evaluating at a bond, there are two primary yield calculations: the current yield and the yield to maturity. Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond. For example, if you buy a bond with a $1,000 face value and an interest rate -- also known as the coupon rate -- of three percent, you'll earn $30 per year in interest. 2022 UPS Rate & Service Guide Determine the service that best meets your needs for domestic, export and import shipping. Also, learn about certain service restrictions that may apply. Section 2 PREPARING A SHIPMENT PAGES 10-26 Information about how you package a shipment, determine the rate and get the shipment to UPS is provided. Section 3 DETERMINING THE RATE PAGES 27-141

How to determine coupon rate. investmentfirms.com › what-is-a-coupon-rateWhat Is a Coupon Rate? How To Calculate Them & What They're ... Apr 13, 2021 · A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond’s face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. how to calculate coupon rate - OpenTuition In the first case, we know the coupon rate and the redemption amount, so we discount each year at the relevant interest rate to get the market value (as the examiner has done in his answer - appreciate that, for example, multiplying by 1.0446^ (-2) is another way of writing 1/ (1.0446^2), which is discounting for 2 years at 4.446%. US Prime Rates from 1955 to April 2022 - Casaplorer Banks use this Fed Funds Rate as a starting point to determine the Prime Lending Rate for their most creditworthy customers. In most cases, the prime rate is 3% or 300 bps above the Fed Funds Rate. For example, if the Fed Funds Rate = 0.5%, the US Prime Interest Rate would equal 0.5% + 3% = 3.5% on average. Discounting Formula | Steps to Calculate Discounted Value ... Coupon Rate=8.00%; Par Value=$1,000; The Spot rate in the market Spot Rate In The Market Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. This rate can be considered for any and all types of products prevalent in the market ranging from consumer products to real ...

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... 5.56 Twist Rate Chart & Recommendations Feb 16, 2022 · We even include a 5.56 twist rate chart that’ll help you determine the likely best ammo to use with your AR-15. A rifled barrel works simply enough: Spiraling grooves and lands on the bore force the bullet to rotate as it passes through the barrel. The bullet continues rotating once it has exited the muzzle, which grants it the gyroscopic ... United States Prime Rate Oct 15, 2018 · Prime Rate Forecast. As of right now, our odds are at 100% (certain) the Federal Open Market Committee will vote to raise the target range for the benchmark fed funds rate, from the current 0.25% - 0.50%, to either 0.50% - 0.75%, or 0.75% - 1.00%, at the May 4 TH, 2022 monetary policy meeting, with the U.S. Prime Rate (a.k.a Fed Prime Rate) rising to either …

Calculate a Forward Rate in Excel - Investopedia Jun 25, 2019 · You need to have the zero-coupon yield curve information to calculate forward rates, even in Microsoft Excel. Once the spot rates along that curve are known (or can be calculated), compute the ... Topic No. 653 IRS Notices and Bills, Penalties, and ... Mar 08, 2022 · The interest rate is determined quarterly and is the federal short-term rate plus 3 percent. Interest compounds daily. Visit Newsroom Search for the current quarterly interest rate on underpayments. In addition, if you file a return but don't pay all tax owed on time, you'll generally have to pay a late payment penalty. smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; $100 / $1,000 = 0.10; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. How to Calculate a Coupon Payment: 7 Steps (with Pictures) If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. 2

How Can I Calculate a Bond's Coupon Rate in Excel? How to Find the Coupon Rate In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Posted by Dinesh on 27-06-2021T07:56 This calculator calculates the coupon rate using face value, coupon payment values.

How Much Does Weed Cost? Cannabis Price Guide 2021 Oct 27, 2018 · How to Determine the Average Weed Prices in Your Location. Because of all of the impending price factors, there is no one and done figure to help you determine pot prices in your locations. However, there are a few things you can do to help determine the going rate near you in order to decide if the prices you pay are fair.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

Discount Rate Formula | How to calculate Discount Rate ... The formula for the discount rate can be derived by using the following steps: Step 1: Firstly, determine the value of the future cash flow under consideration. Step 2: Next, determine the present value of future cash flows. Step 3: Next, determine the number of years between the time of the future cash flow and the present day. It is denoted by n.

Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

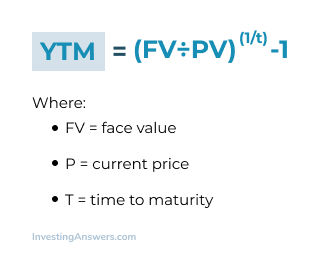

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate remains fixed over the lifetime of the bond, while the yield-to-maturity is bound to change. When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals ...

Post a Comment for "43 how to determine coupon rate"