43 calculate coupon rate in excel

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Calculate NPV in Excel - Net Present Value formula - Ablebits.com 10.07.2019 · The Excel NPV function cannot adjust the supplied rate to the given time frequencies automatically, for example annual discounting rate to monthly cash flows. It is the user's responsibility to provide an appropriate rate per period. Incorrect rate format. The discount or interest rate must be provided as a percentage or corresponding decimal ...

Discounting Formula | Steps to Calculate Discounted Value … Coupon Rate=8.00%; Par Value=$1,000; The Spot rate in the market Spot Rate In The Market Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. This rate can be considered for any and all types of products prevalent in the market ranging from consumer products to real estate to capital …

Calculate coupon rate in excel

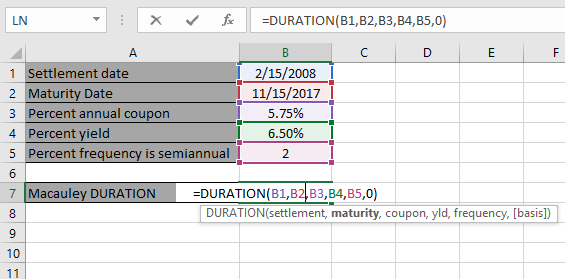

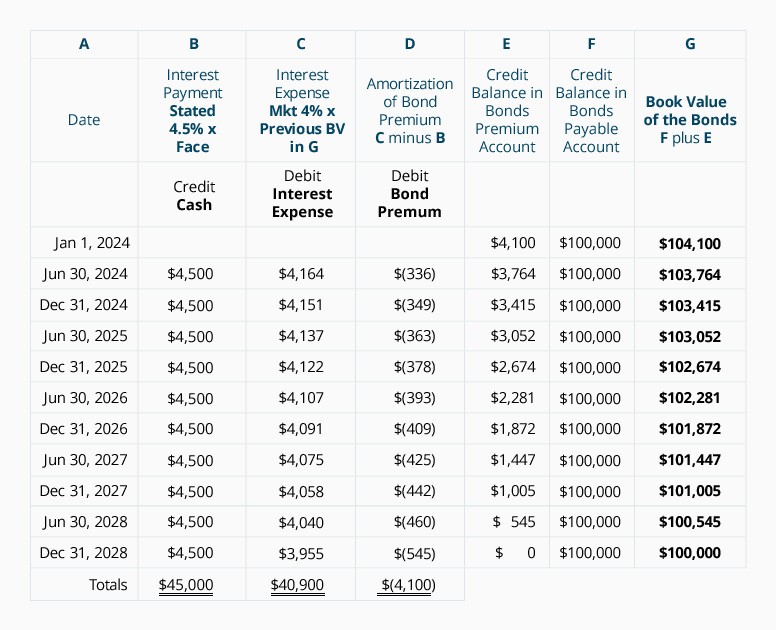

Yield of a Coupon Bond calculation using Excel. How to ... Calculating the Yield of a Coupon Bond using Excel In this article, we're going to talk about how to calculate the yield of maturity for a coupon bond. For a coupon bond, we're talking about a bond that's going to pay periodic interest payments. How to calculate Spot Rates, Forward Rates & YTM in EXCEL ... The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond ). Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

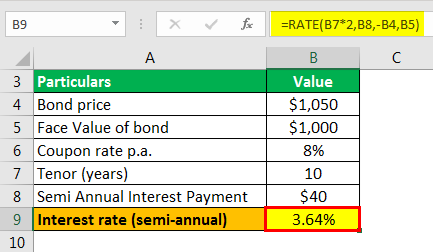

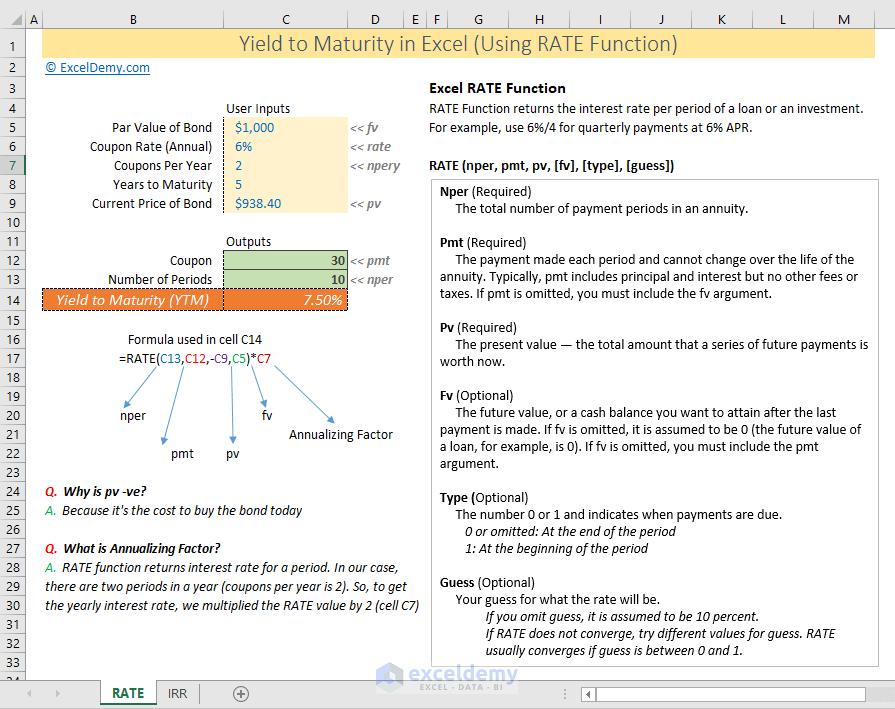

Calculate coupon rate in excel. How to calculate discount rate or price in Excel? Select a blank cell, for instance, the Cell C2, type this formula =A2- (B2*A2) (the Cell A2 indicates the original price, and the Cell B2 stands the discount rate of the item, you can change them as you need), press Enter button and drag the fill handle to fill the range you need, and the sales prices have been calculated. See screenshot: Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1 How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments... Using RATE function in Excel to calculate interest rate ... The RATE function in Excel can also be used for calculating the compound annual growth rate (CAGR) on an investment over a given period of time. Supposing you want to invest $100,000 for 5 years and receive $200,000 in the end. How will your investment grow in terms of CAGR?

Excel PRICE Function - Calculate Bond Price E = number of days in coupon period in which the settlement date falls. A = number of days from the beginning of the coupon period to the settlement date. What Is Excel PRICE Function? The Excel PRICE function calculates the price of a bond or security per $100 face value, which also pays period interest. Calculate Price of a corporate bond Using Excel formulas to figure out payments and savings Using the function PMT(rate,NPER,PV) =PMT(17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two years. The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year. Calculate the Interest or Coupon Payment and Coupon Rate ... This Excel Finance tutorial shows you how to calculate the coupon payment or interest payment as well as the coupon rate of a bond. This is a very helpful technique that allows you to use other information about a bond in order to determine the coupon related information. How to Calculate Compound Interest: 15 Steps (with Pictures) 04.02.2022 · Calculate interest compounding annually for year one. Assume that you own a $1,000, 6% savings bond issued by the US Treasury. Treasury savings bonds pay out interest each year based on their interest rate and current value. Interest paid in year 1 would be $60 ($1,000 multiplied by 6% = $60). To calculate interest for the second year, you need to add …

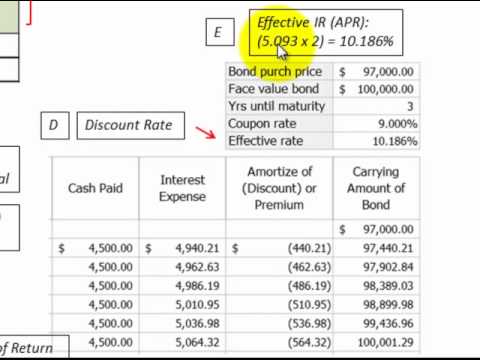

Coupon Bond Formula | Examples with Excel Template Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, RATE Function - Formula, Examples, How to Use RATE Function For a financial analyst, the RATE function can be useful to calculate the interest rate on zero coupon bonds. Formula =RATE (nper, pmt, pv, [fv], [type], [guess]) The RATE function uses the following arguments: Nper (required argument) - The total number of periods (months, quarters, years, etc.) over which the loan or investment is to be paid.

Calculate a Forward Rate in Excel - Investopedia This can be otherwise written as "= (100 x 1.04)" in Excel. It should produce $104. The final two-year value involves three multiplications: the initial investment, interest rate for the first year...

Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates

Yield to Maturity Calculation in Excel | Example YIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price, principal amount and coupon payment frequency per year.. In the context of debt securities, yield is the return that a debt-holder earns by investing in a security at its current price.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Coupon Rate Calculator. This calculator calculates the coupon rate using face value, coupon payment values.

IRR function in Excel to calculate internal rate of return - Ablebits 17.07.2019 · Where: Values (required) – an array or a reference to a range of cells representing the series of cash flows for which you want to find the internal rate of return.; Guess (optional) – your guess at what the internal rate of return might be. It should be provided as a percentage or corresponding decimal number. If omitted, the default value of 0.1 (10%) is used.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How to calculate discount rate or price in Excel? - ExtendOffice Calculate discount rate with formula in Excel. The following formula is to calculate the discount rate. 1. Type the original prices and sales prices into a worksheet as shown as below screenshot: 2. Select a blank cell, for instance, the Cell C2, type this formula =(B2-A2)/ABS(A2) (the Cell A2 indicates the original price, B2 stands the sales price, you can change them as you need) into …

Coupon Rate Template - Free Excel Template Download C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Excel Modeling Templates PowerPoint Presentation Templates

Post a Comment for "43 calculate coupon rate in excel"