39 ytm for coupon bond

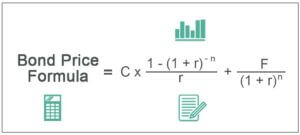

Problem 1: a K = Nx2 Bond Price = ((Semi Annual Coupon)/(1 + YTM/2)^k ... K = Nx2 Bond Price = ( (Semi Annual Coupon)/ (1 + YTM/2)^k] YTM/2)^Nx2 + Par value/ (1+ k=1 K =15×2 Bond Price = | (12*1000/2001 (1 + 12/2007k] + 1000/ (1 + 12/200)^15×2 ke1 Bond Price 1000 John has just bought an 8% bond that pays semi-annual coupons with $1,000 face value and 8 years… In "Finance" TVA Bonds: U.S. Government Credit Rating At Over 4% Yield To Maturity The coupon would reset lower in the unlikely event 30-year Treasuries yield under 1.19% (TVC) or 1.389% (TVE) but a built-in put option exists to sell the bonds at $25. At over 4% YTM, these bonds...

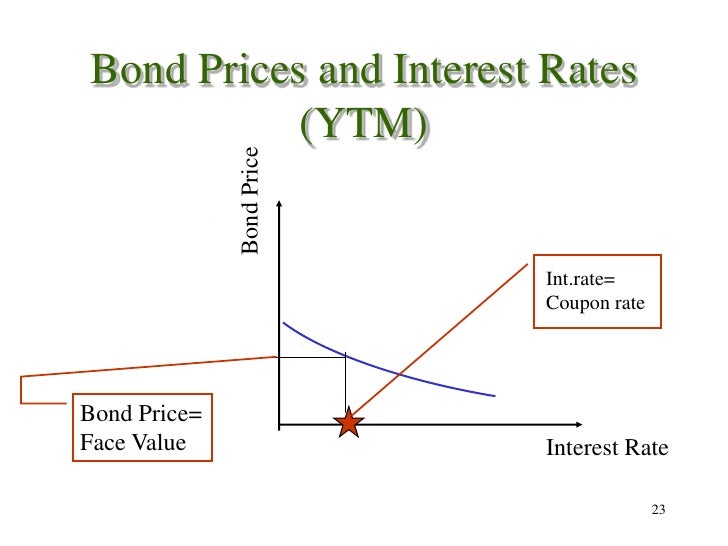

Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Ytm for coupon bond

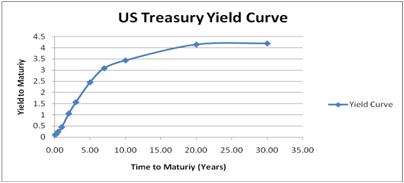

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.924% yield.. 10 Years vs 2 Years bond spread is -20.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 21.00 and implied probability of ...

Ytm for coupon bond. Constant Yield Method Definition - Investopedia For simplicity's sake, let's assume it is compounded annually. For this example, the YTM can be calculated as: $100 par value = $75 x (1 + r) 10 $100/$75 = (1 + r) 10 1.3333 = (1 + r) 10 r = 2.92%... United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.093% yield.. 10 Years vs 2 Years bond spread is 16.6 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 18.00 and implied probability of default ... NSE - National Stock Exchange of India Ltd. INDIAN RAILWAY FINANCE CORPORATION LIMITED 7.18/7.68 BD 19FB23 FVRS1000 LOA UPTO 18FB13. 103.0187. 3.5507. 2. 3504.48. 103.0193. 3.5500. INE157D08027. CLIX CAPITAL SERVICES PRIVATE LIMITED SR-B RR NCD 27JU23 FVRS10LAC. How To Easily Estimate A Bond Fund's Expected Returns Yield to maturity is simply the expected annual returns of the bond if held to maturity, meaning income + capital gains. From the above, yield to maturity would equal 0.63% + 2.7% = 3.33%. IEF's...

WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 130 ... Canada 10-Year Bond Yield | WOWA.ca Depending on the coupon structure, the yield on a bond may be calculated differently. The simplest formula for finding a bond yield is as follows: \textnormal {Bond Yield} = \frac {\textnormal {Coupon Payments}} {\textnormal {Bond Price}} Bond Yield = Bond PriceCoupon Payments The yield calculated in this way is called a current yield. FORD MOTOR CREDIT CO. LLCDL-NOTES 2020(20/25) Bond | Markets Insider The Ford Motor Credit Co. LLC-Bond has a maturity date of 6/16/2025 and offers a coupon of 5.1250%. The payment of the coupon will take place 2.0 times per biannual on the 16.12.. LiveLive Market Watch - Bonds Trade In Capital Market, NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest. YOU ARE ON THE NEW NSE WEBSITE, ACCESS THE OLD WEBSITE ON THE URL www1.nseindia.com. Normal Market has Closed. 110.55 (0.69%) ... YTM computation is based on the Corporate Action dates available with the Exchange.

You bought an 8-year bond with $1,000 face value with semi-annual ... You bought an 8-year bond with $1,000 face value with semi-annual coupon at 6.5% when the YTM is 75%. You sold the bond after 25 years when the YTM changed to 7%. In between, you reinvested all the coupons at a rate of 7.25%. a) Calculate the purchase price of the bond. Show steps or calculator keystrokes. Perù Government Bonds - Yields Curve Last Update: 17 Jul 2022 23:15 GMT+0. The Perù 10Y Government Bond has a 8.370% yield. 10 Years vs 2 Years bond spread is 201 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.00% (last modification in July 2022). The Perù credit rating is BBB, according to Standard & Poor's agency. What is a Coupon Value? Definition and Calculation A $1,000 bond with a 3.50% coupon rate pays $35, yielding 3.50% If the bond price increase to $1,050, the payment remains $35, but the bond yield drops to 3.33% If the bond price decreases to $950, the bond yield rises to 3.68%, but the $35 annual payment remains fixed Flat Bond Definition - Investopedia Say the coupon rateon a $1,000 par valuebond that pays interest semi-annually on February 1 and August 1 each year is 5%. The bondholder sells the bond on April 15 in the secondary market for a...

How do I Calculate Zero Coupon Bond Yield? (with picture) Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds.

AMAZON.COM INC.DL-NOTES 2017(17/27) Bond - Insider The Amazon.com Inc.-Bond has a maturity date of 8/22/2027 and offers a coupon of 3.1500%. The payment of the coupon will take place 2.0 times per biannual on the 22.02.. At the current price of 98 ...

What is Weighted Average Maturity? (with picture) - wiseGEEK The term weighted average maturity is also applied to a calculation used to evaluate bonds. Called the Macaulay duration and named for economist Frederick Macaulay, this calculation is designed to help account for the risk of changing interest rates on the value of a bond.Macaulay determined that unweighted averages were not helpful in attempting to predict such risks.

Night Hawk Co. Issued 15 Year Bond - Andrew Jacobson Bond Y is a discount bond making annual payments. This bond pays a 7 percent coupon, has a YTM of 9 percent, and also has 13 years to maturity. What are the prices of these bonds today? If interest rates remain unchanged, what do you expect the prices of these bonds to be in one year? In three years? In eight years? in 12 years'1 In 13 years?

STARBUCKS CORP.DL-NOTES 2016(16/26) Bond - Insider The Starbucks Corp.-Bond has a maturity date of 6/15/2026 and offers a coupon of 2.4500%. The payment of the coupon will take place 2.0 times per biannual on the 15.12.. At the current price of 96 ...

How to Compare the Yields of Different Bonds - Investopedia APY = (1 + 0.03)^2 - 1 = 6.09\% AP Y = (1+ 0.03)2 −1 = 6.09% Yields on Treasury notes and bonds, corporate bonds, and municipal bonds are quoted on a semi-annual bond basis (SABB) because their...

Colombia Government Bonds - Yields Curve The Colombia 10Y Government Bond has a 13.300% yield.. 10 Years vs 2 Years bond spread is 180 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 7.50% (last modification in June 2022).. The Colombia credit rating is BB+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 149.16 and implied probability of default is 2.49%.

Current Coupon Definition - Investopedia A current coupon refers to a security that is trading closest to its par value without going over par. In other words, the bond's market price is at or near to its issued face value. Put...

Post a Comment for "39 ytm for coupon bond"