41 coupon rate vs ytm

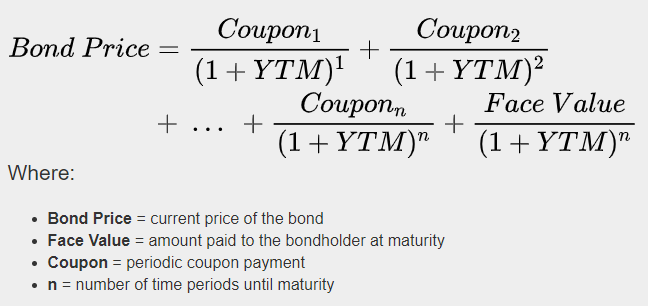

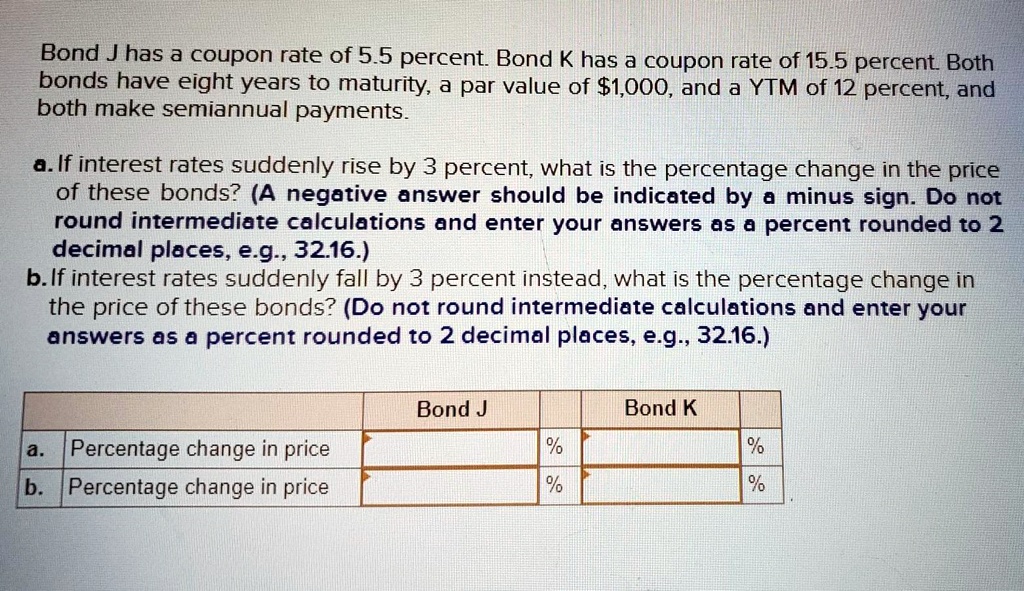

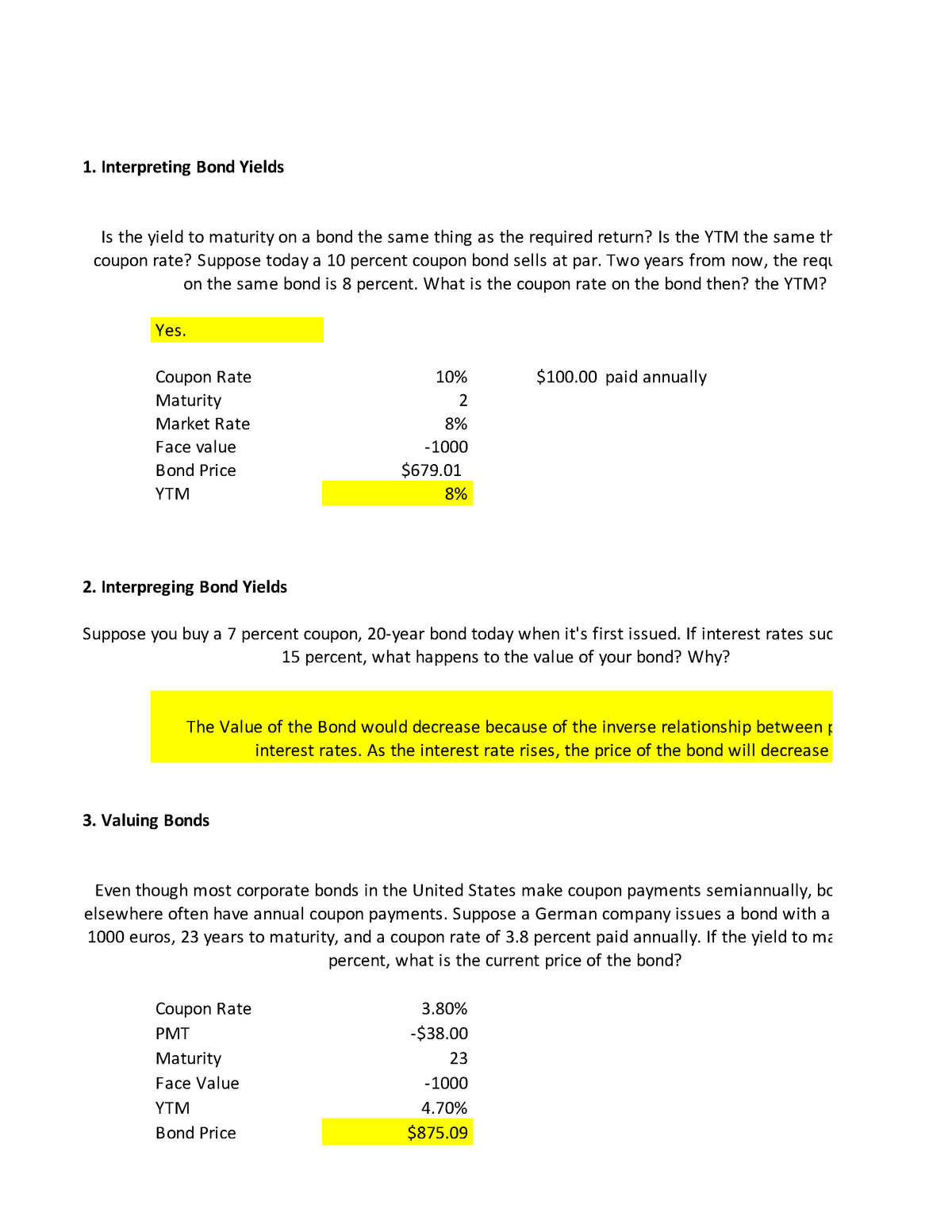

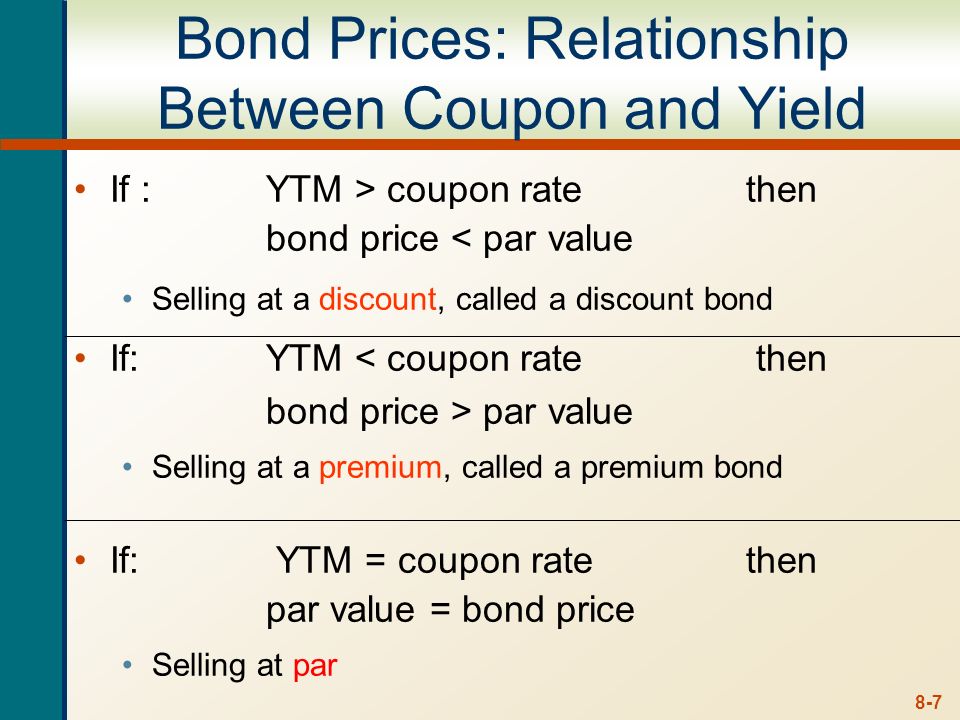

Coupon Rate Calculator | Bond Coupon 15.07.2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond … How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia 28.07.2022 · How to Find the Coupon Rate . In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1 ...

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? 23.01.2022 · The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering ...

Coupon rate vs ytm

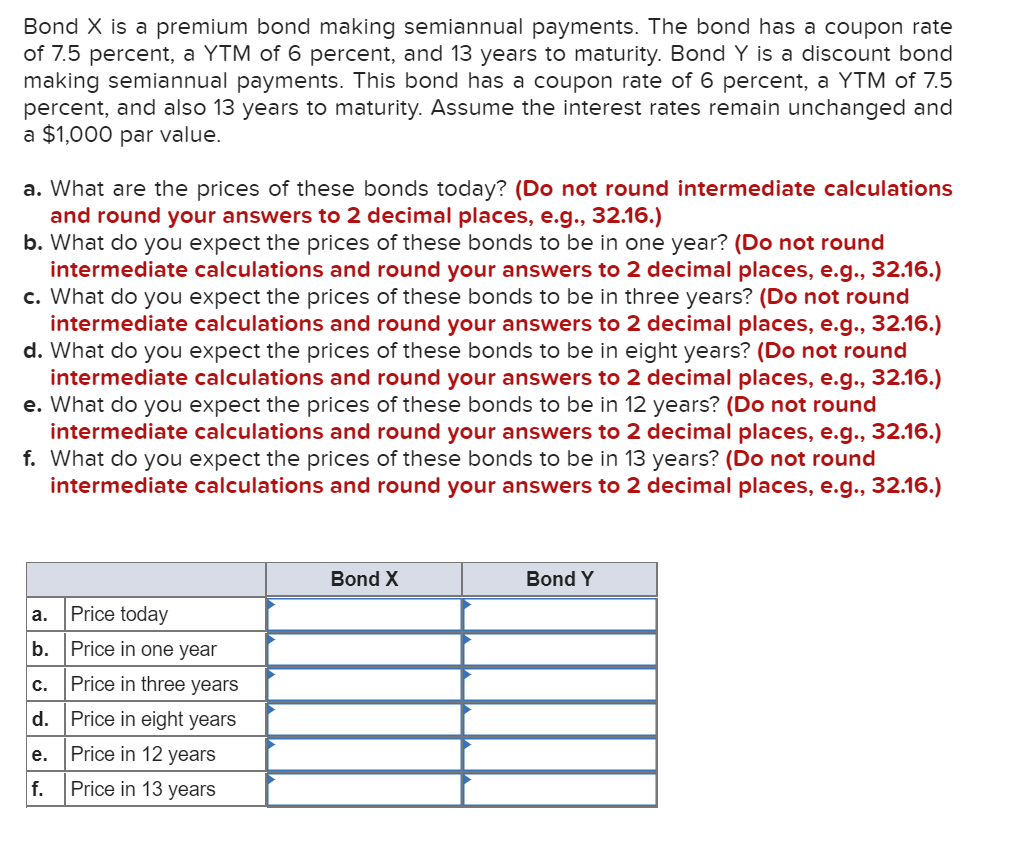

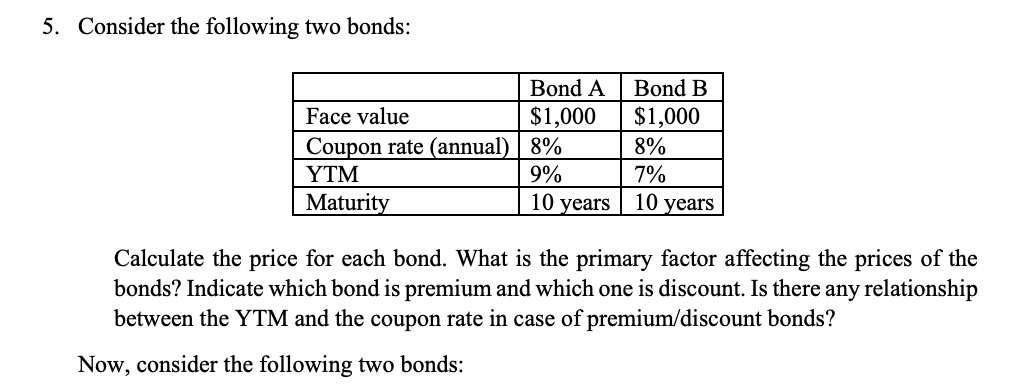

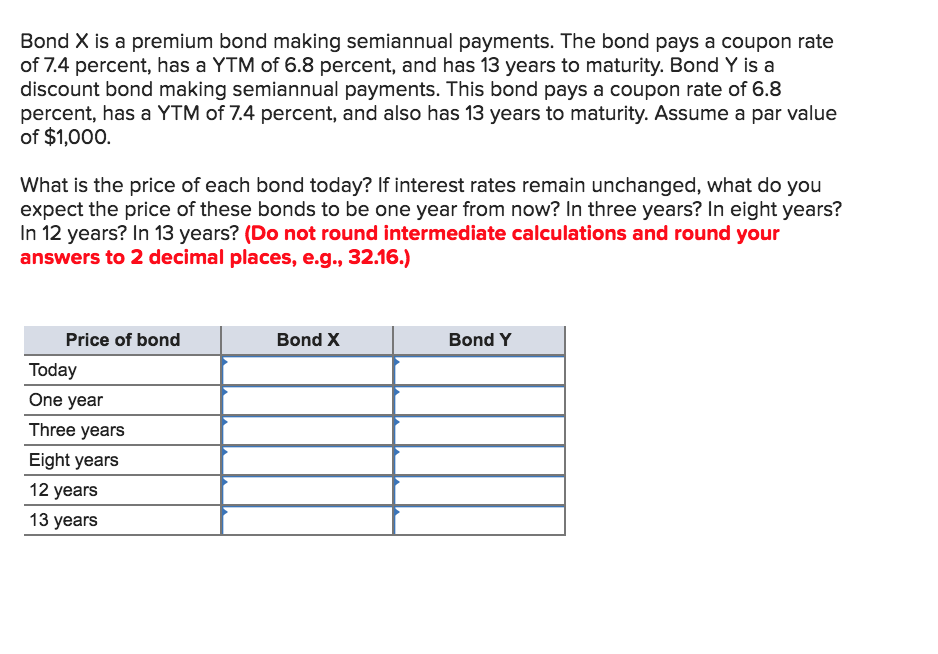

Coupon Rate vs Interest Rate | Top 8 Best Differences (with … Coupon Rate vs. Interest Rate – Key Differences. The key differences between Coupon Rate vs. Interest Rate are as follows – The coupon rate is calculated on the face value of the bond Value Of The Bond Bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. read more, which is being invested. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · Yield to Maturity vs. Coupon Rate: An Overview When investors consider buying bonds they need to look at two vital pieces of information: the yield to maturity (YTM) and the coupon rate.

Coupon rate vs ytm. Bond Yield: What It Is, Why It Matters, and How It's Calculated 31.05.2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset 26.08.2022 · Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered ... Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Bond: Financial Meaning With Examples and How They Are Priced 01.07.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · Yield to Maturity vs. Coupon Rate: An Overview When investors consider buying bonds they need to look at two vital pieces of information: the yield to maturity (YTM) and the coupon rate. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Coupon Rate vs Interest Rate | Top 8 Best Differences (with … Coupon Rate vs. Interest Rate – Key Differences. The key differences between Coupon Rate vs. Interest Rate are as follows – The coupon rate is calculated on the face value of the bond Value Of The Bond Bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. read more, which is being invested.

Post a Comment for "41 coupon rate vs ytm"