44 relationship between coupon rate and ytm

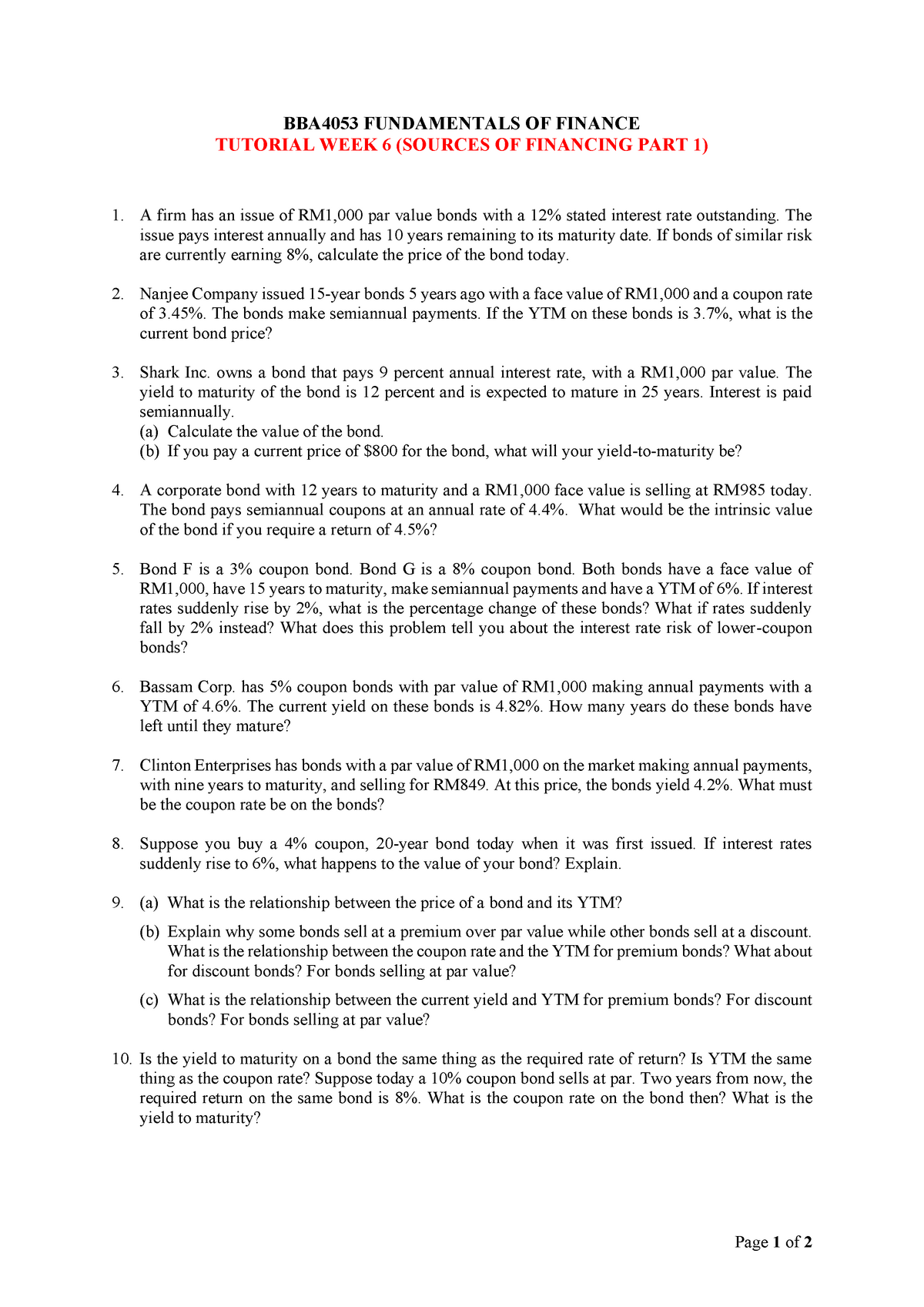

What is Yield to Maturity? (YTM Formula + Calculator) - Wall … An important distinction between a bond’s YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. The relationship between the yield to maturity and coupon rate (and current yield) are as follows. YTM < Coupon Rate and Current Yield → The bond is being sold ... How to Calculate Yield to Maturity: 9 Steps (with Pictures) 20.11.2022 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. Remember, though, you're plugging in an estimated i for semi-annual payments. That ...

What is the relationship between coupon rate required yield and price ... Is YTM the same as coupon rate? YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Post navigation

Relationship between coupon rate and ytm

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang YTM = { (Annual Interest Payment) + [ (Face Value - Current Trading Price) ÷ Remaining Years To Maturity]} ÷ [ (Face Value + Current Price) ÷ 2] Let's understand with the help of an example given below: An investor has a bond with a face value of RS 10,000 and a coupon rate of 10%. Yield to Maturity vs. Coupon Rate: What's the Difference? 20.5.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Relationship between coupon rate and ytm. Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. The Relation of Interest Rate & Yield to Maturity | Pocketsense Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80. Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... What is Yield to Worst? (YTW Formula + Calculator) - Wall Street … As for the coupon, we’ll assume that the bond pays an annual coupon at an interest rate of 6%. Frequency of Coupon: 1; Coupon Rate: 6%; Annual Coupon: $60; Now, we’ll enter our assumptions into the Excel formula from earlier to calculate the yield to maturity (YTM): Yield to Maturity (YTM): “= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote ...

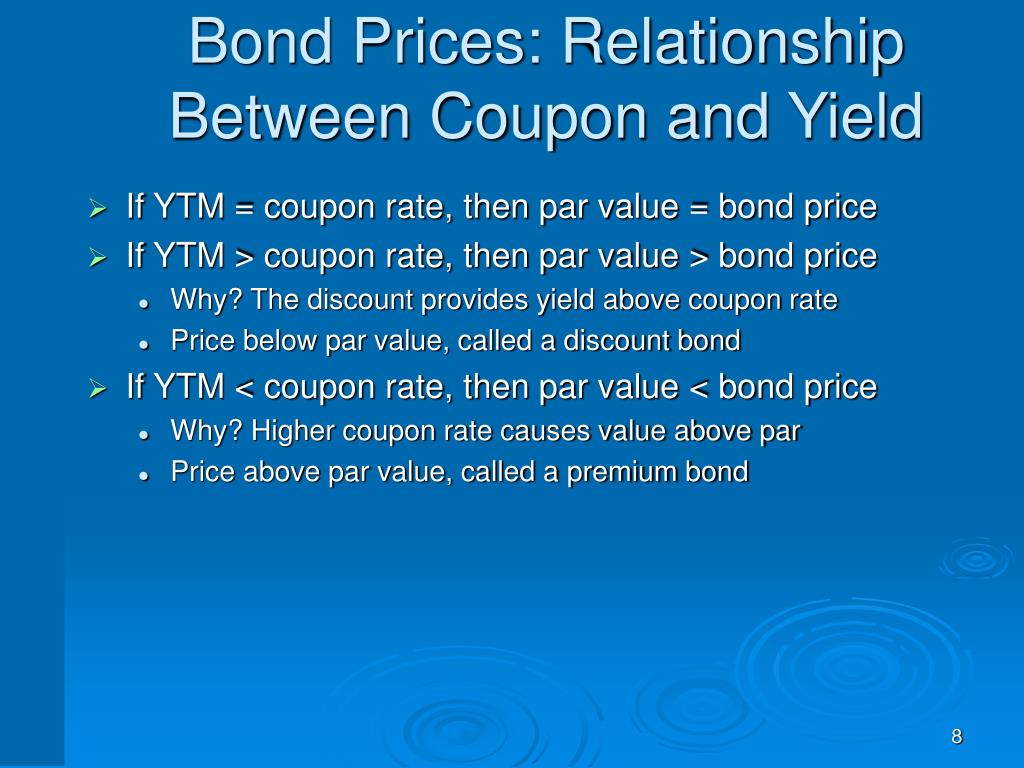

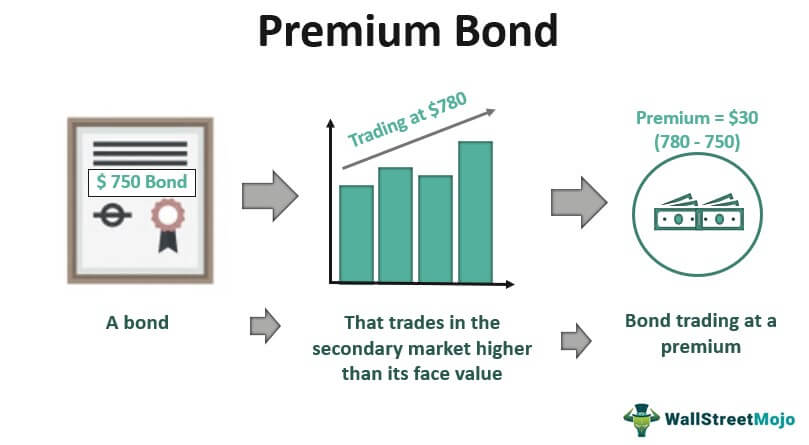

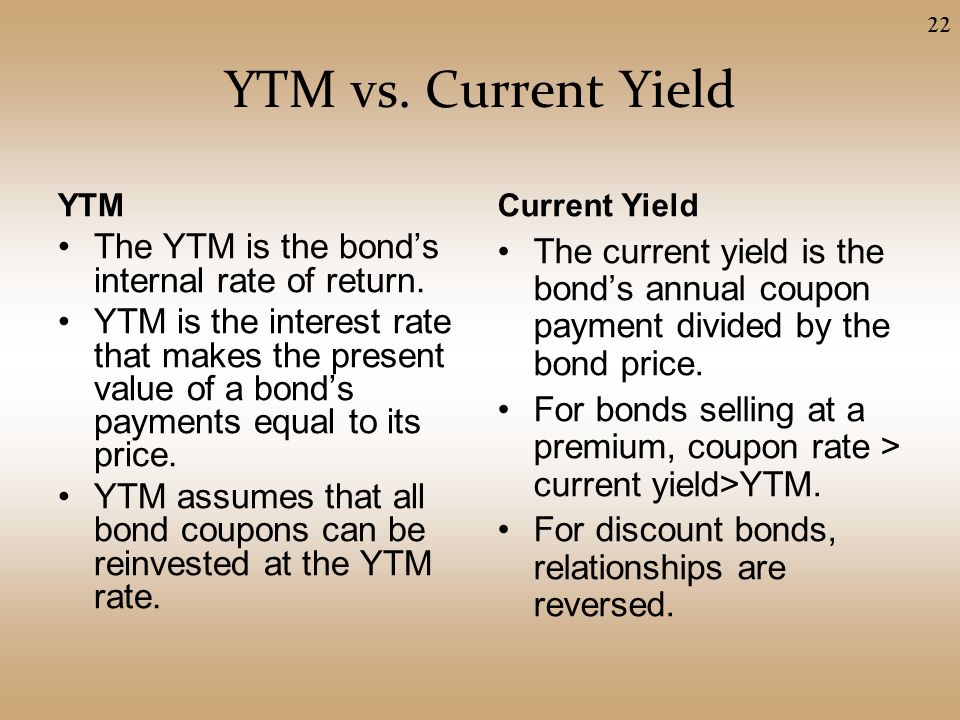

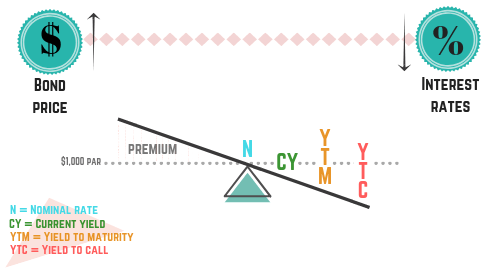

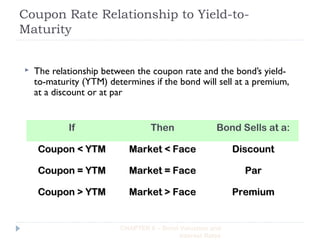

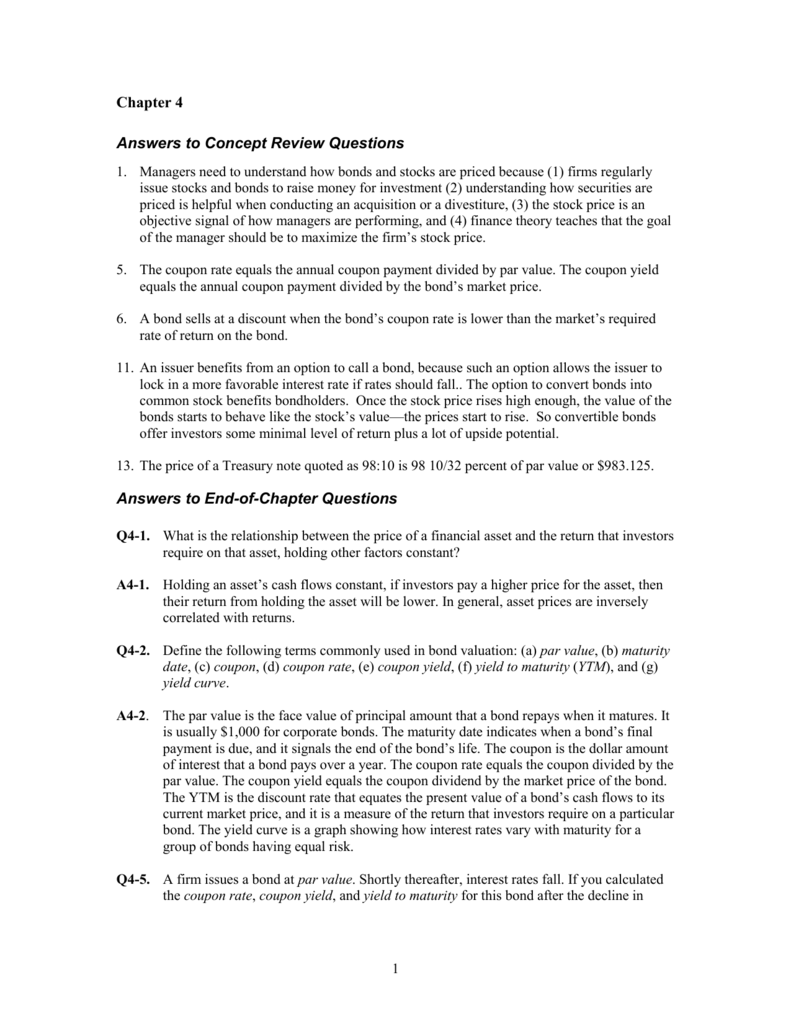

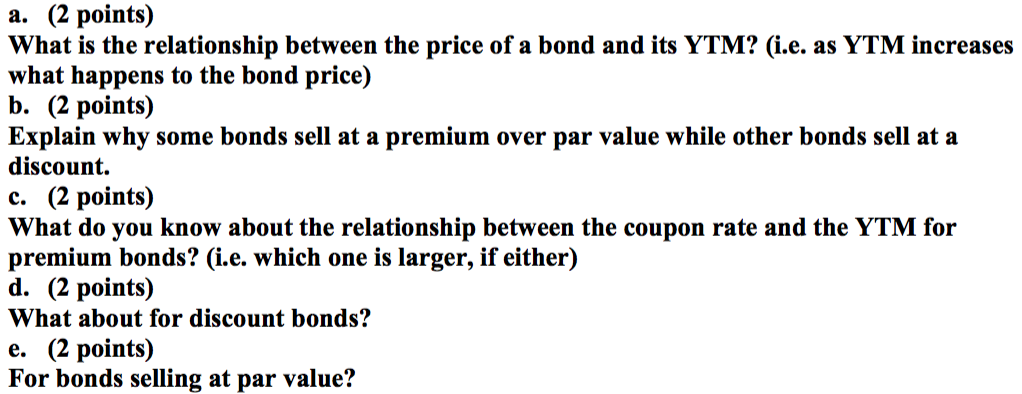

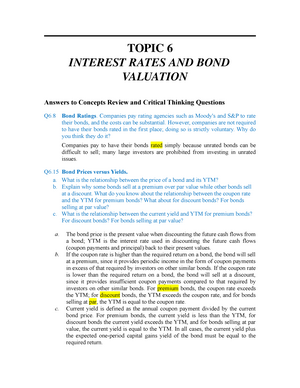

Current Yield vs. Yield to Maturity - Investopedia Bond Yield As a Function of Price When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a... Solved Explain the relationship between the coupon rate and | Chegg.com Explain the relationship between the coupon rate and the ytm. Discuss the 3 cases arising from that relationship. Please be detailed in your response. Expert Answer Describe how the coupon rate and ytm are related. The yield to maturity, or YTM, is the rate of return on a bond if it is kept until maturity. The cou … View the full answer Relationship between bond price and YTM - brainmass.com The yield to maturity (YTM) is the required return by the investor on the bond. It is calculated by discounting the expected cash flows by the required return an dequating these discounted cash flows to the price of the bond. The relationship can be expressed matematically as. Price=Discounted Cash Flows (Interest+Principal) at rate Kd. The Relationship Between a Bond's Price & Yield to Maturity However, if you only pay $900 for the bond, your yield to maturity will be greater because, in addition to the 6 percent interest, you'll earn a capital gain of $100. If you paid more than $1,000 for the bond, your yield to maturity would be less than 6 percent, as you would get back less than you paid at maturity. 00:00 00:00.

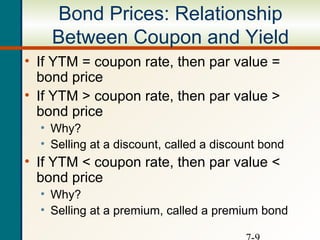

What is Bond Yield? (Formula + Calculator) - Wall Street Prep Calculating the current yield of a bond is a three-step process: Step 1: The current bond price can be readily observed in the markets – in which the bond can either trade at a discount, at par or at a premium to par.; Step 2: The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the coupon rate must be annualized. Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If coupon rate > YTM, the bond will sell for more than par value or at a premium. If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Bond Yield | Nominal Yield vs Current Yield vs YTM - XPLAIND.com Where P 0 is the current bond price, c is the annual coupon rate, m is the number of coupon payments per year, YTM is the yield to maturity, n is the number of years the bond has till maturity and F is the face value of the bond.. The above equation must be solved through hit-and-trial method, i.e. you plug-in different numbers till you get the right hand side of the equation equal to the left ... Coupon Rate - Meaning, Calculation and Importance - Scripbox Following is the relationship between the bond prices with the couponrate and YTM. Purchase Price of a Bond: Coupon Rate: Yield to Maturity (YTM) Face Value: 15%: 15%: Higher than the face value (at a premium) 15%: Lower than the coupon rate: Lower than the face value (at a discount) 15%:

Relationship Between Yield To Maturity and Coupon Rate - LiquiSearch a discount: YTM > current yield > coupon yield a premium: coupon yield > current yield > YTM par: YTM = current yield = coupon yield. Current Yield = Total Yield - Capital Gains Yield The current yield is the annual payment divided by the price. Algebraically expressed as Y = R/P, where Y is yield, R is the annual payment, and P represents price.

Bond: Financial Meaning With Examples and How They Are Priced 1.7.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

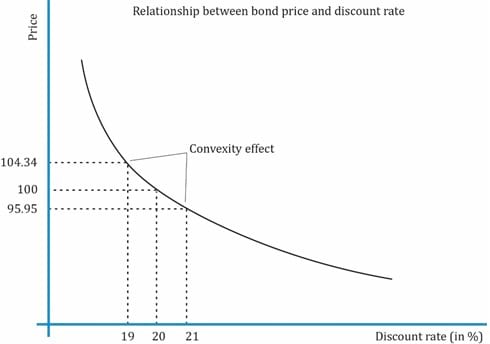

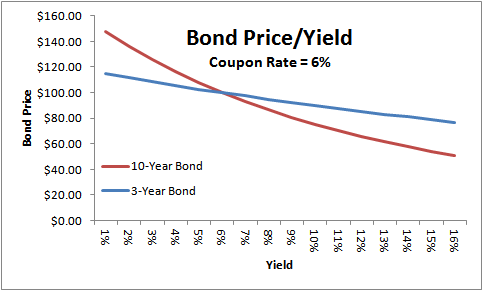

Relationship between coupon rate and yield is inverse| Knowledge Center ... Bond Price = Coupon Rate / (1 + YTM)^n + Par Value / (1+YTM)^n. This formula shows that the relationship between coupon rate and yield is inverse. If coupon rates increase, then the price of the ...

The Relation of Interest Rate & Yield to Maturity - Zacks Yield to Maturity Defined. A bond's yield to maturity accounts for the price that is paid for a bond as well as the coupons and final principal payment a bondholder receives when the bond ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

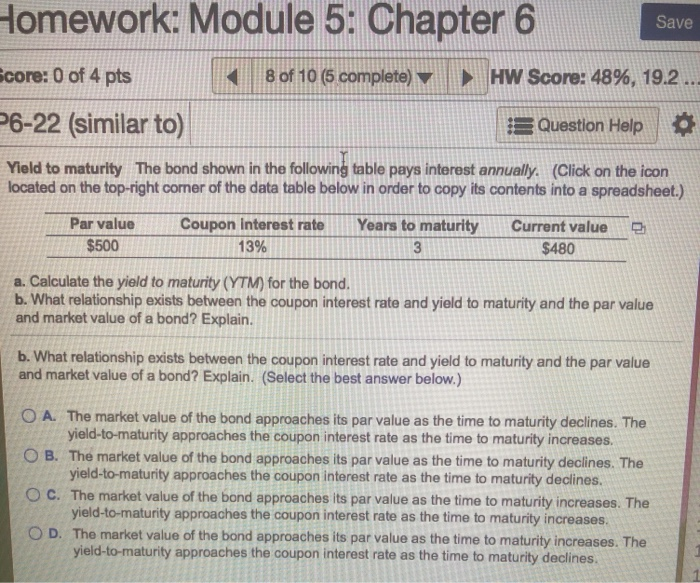

Solved what relationship exists between the coupon interest - Chegg The yield-to-maturity approaches the coupon interest rate as the time to maturity increases O D. The market value of the bond approaches its par value as the time to maturity increases. The yield-to-maturity approaches the coupon interest rate as the time to maturity declines. Previous question Next question

Relationship Between Bond Price & Yield to Maturity If a bond has a face value of $1,000 and you pay $1,000 to buy the bond, your yield to maturity will be the same as the interest rate of the bond. However, if you pay less than $1,000 for that bond, your yield to maturity will be higher. Say, for example, you pay $900 for a bond with a face value of $1,000. In addition to the regular interest ...

What is the difference between the YTM and the coupon rate? The YTM or Yield to Maturity is the yield based on the current price of the bond. For example, if a $1000 bond maturing in 10 years is issued at 5%, then 5% is the coupon rate, which means it will always pay $50 per year until maturity. However, if you are able to buy that bond at only $900, then your YTM is 6.367% because it take Continue Reading

Relationship Between Coupon and Yield - Assignment Worker • Coupon rate = 14% - Semiannual • YTM = 16% (APR) • Maturity = 7 years - Number of coupon payments? (2t or N) • 14 = 2 x 7 years - Semiannual coupon payment? (C/2 or PMT) • $70 = (14% x 1000)/2 - Semiannual yield? (YTM/2 or I/Y) • 8% = 16%/2

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

chapter 6 homework review Flashcards | Quizlet Terms in this set (6) downward slope indicates interest rates will be. lower in the long term. reasons why risk bond is below interest rate. shift in supply demand relationship. change in risk. the value of a bond is the present value of the. interest payments and maturity value. explain the relationship that exists between the coupon interest ...

Chapter 10 concept questions Flashcards | Quizlet In any present value calculation, the present value declines when the interest rate increases. a) What is the relationship between the price of a bond and its YTM? (b) Explain why some bonds sell at a premium to par value, and other bonds sell at a discount. What do you know about the relationship between the coupon rate and the YTM for premium ...

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

What relationship between a bond's coupon rate and a bond's yield would ... If the bond yield exceeds the coupon then the bond will trade on a clean price below par or at a discount. Conversely if the yield is lower than the coupon rate the bond will trade at premium to par. Yield up = price down Yield down = price up Sponsored by Lightbulb Camera Inc. How could this new lightbulb camera keep millions of people safe?

YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India - The Fixed Income Scenario 1: interest rates rose to 8.0% Increased interest rate will drive the coupon rate (8.0%) on the newly issued bonds to be higher than the coupon rate on the existing bonds (7.5%). This will lead to an increase in the YTM of the existing bond, which now equates to YTM on the newly issued bond, being 8.0%; while the market price of the ...

Difference between Coupon Rate And Yield To Maturity YTM = { (annual interest payment) + [ (face value - current trading price) ÷ remaining years to maturity]} ÷ [ (face value + current price) ÷ 2] Let's take up an example to better understand the concept of yield to maturity. Assume that there's a bond with a face value of Rs. 10,000 with a coupon rate of 10%.

Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

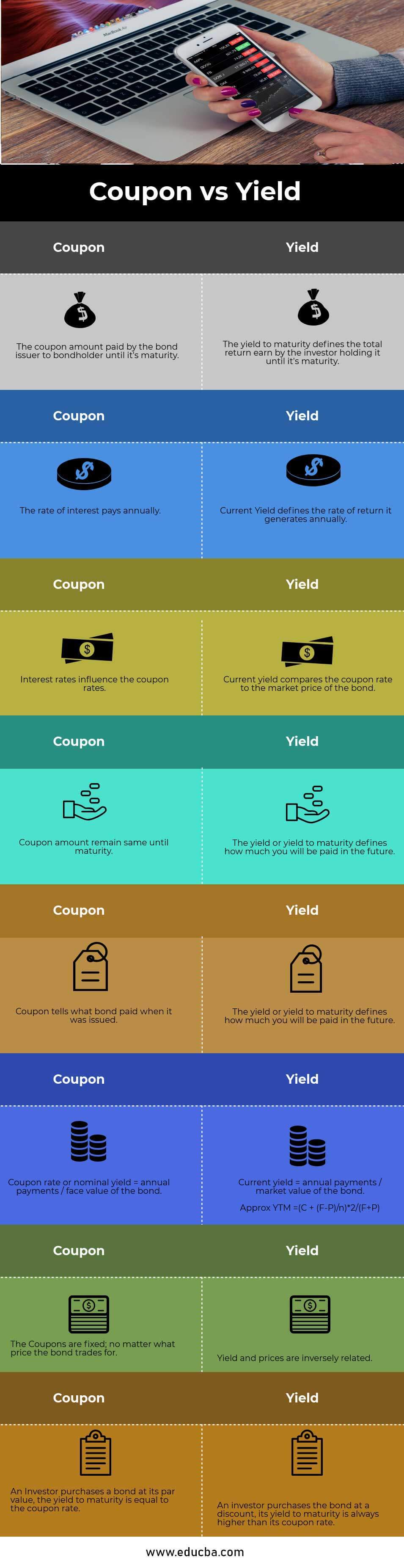

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

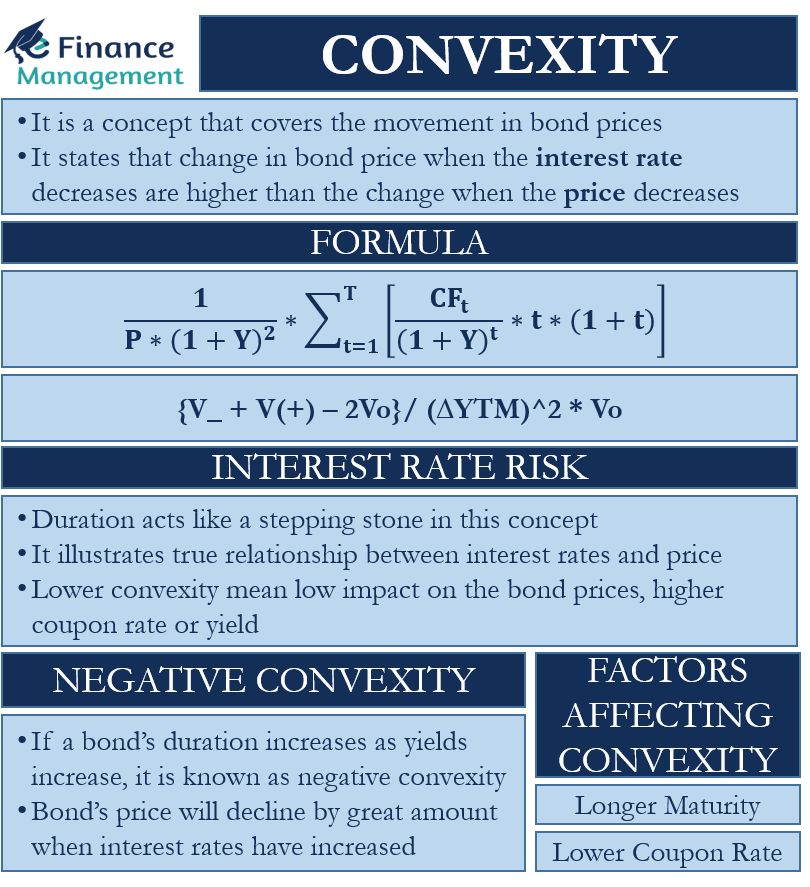

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Coupon Rate Calculator | Bond Coupon 15.7.2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond …

FIN 311- Chapter 7 Homework Flashcards | Quizlet Assume that a $1,000,000 par value, semiannual coupon U.S. Treasury note with four years to maturity (YTM) has a coupon rate of 5%. The yield to maturity of the bond is 11%. Using this information and ignoring the other costs involved calculate the value of the Treasure note:

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.5.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang YTM = { (Annual Interest Payment) + [ (Face Value - Current Trading Price) ÷ Remaining Years To Maturity]} ÷ [ (Face Value + Current Price) ÷ 2] Let's understand with the help of an example given below: An investor has a bond with a face value of RS 10,000 and a coupon rate of 10%.

Post a Comment for "44 relationship between coupon rate and ytm"