44 treasury bill coupon rate

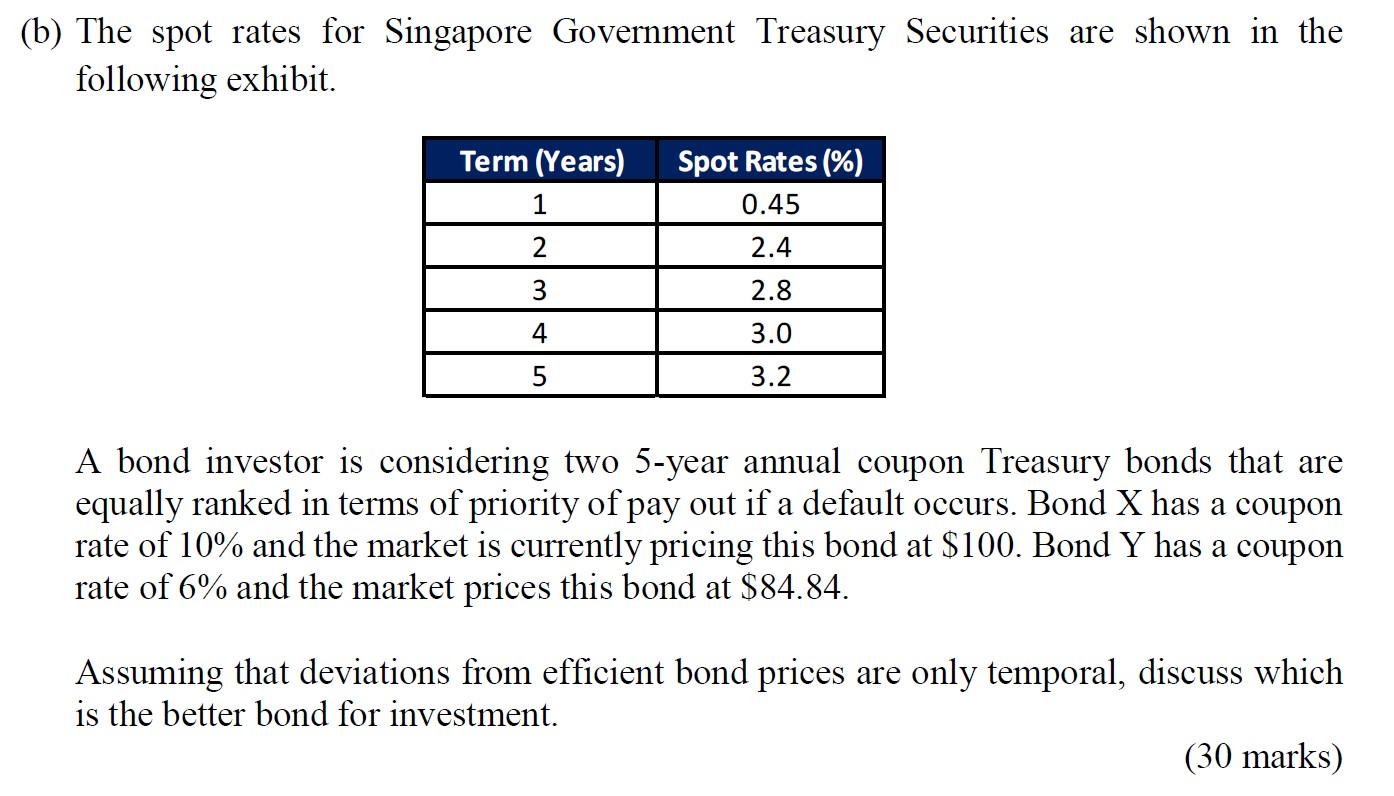

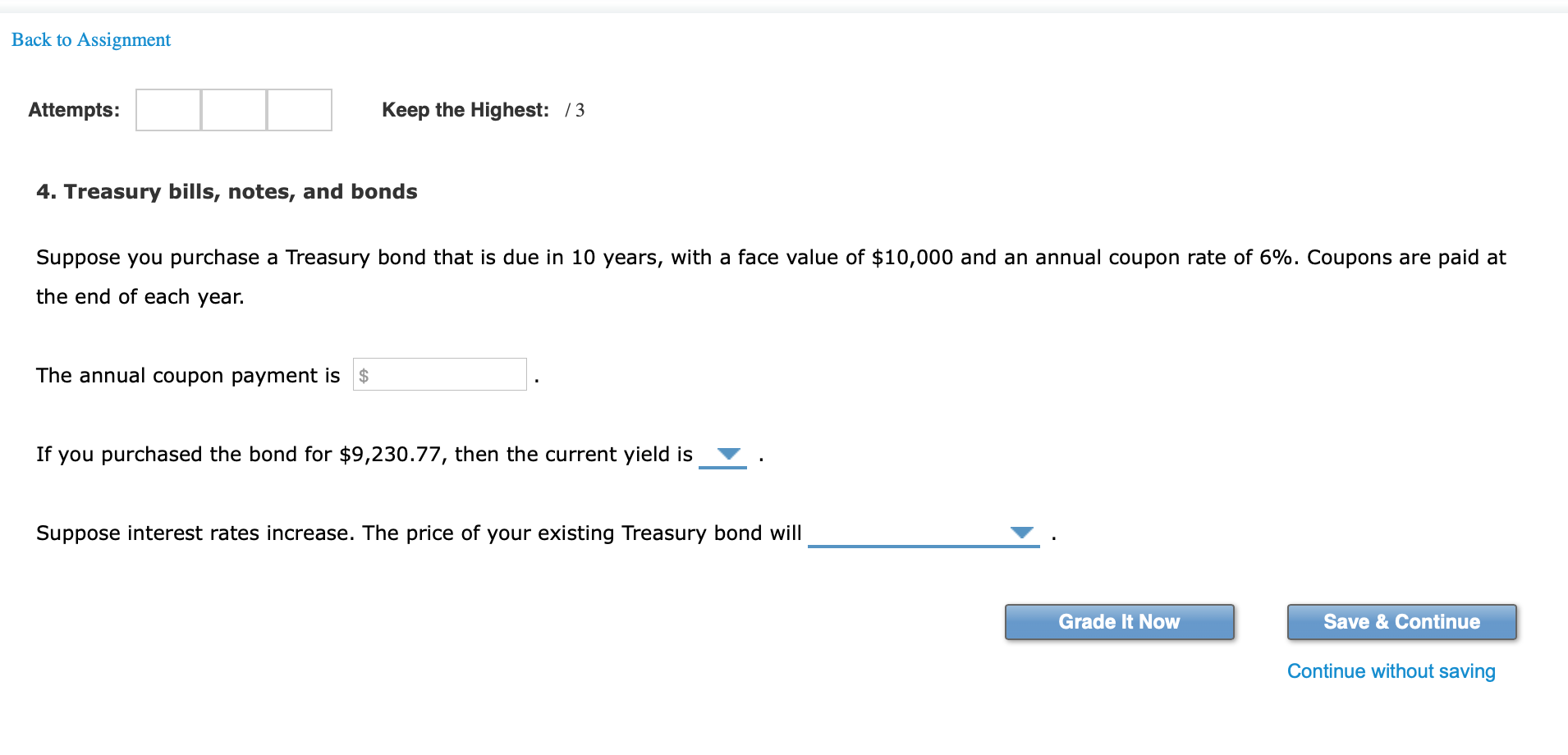

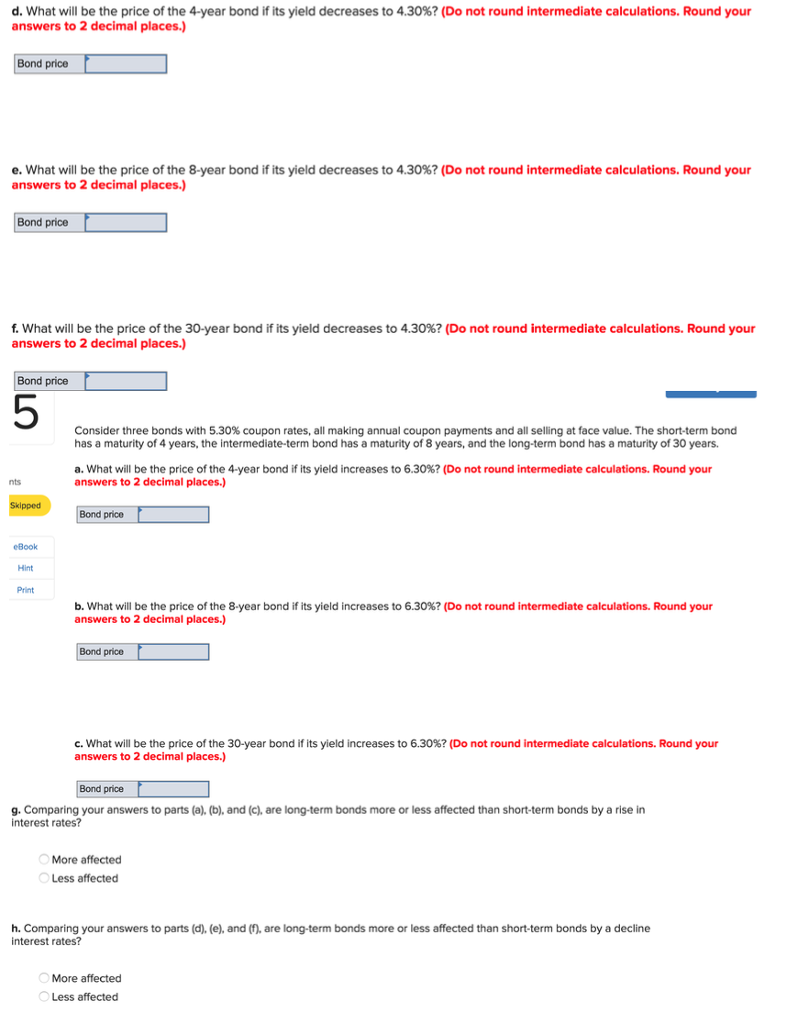

Treasury Bills - Types, Features and Advantages of Government ... - Groww Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding. Interest Rate On Treasury Bills - InterestProTalk.com The FD InterestRates of most banks are around 6% while the treasurybillrate for 2018 is 6.40% for 91 days, 6.52% for 182 days and 6.65% for 364 days. ... The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasurybills or zero-coupon bonds, do not pay a regular coupon. Instead, they ...

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present

Treasury bill coupon rate

Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 28 Nov 2022: 1826: 182 DAY BILL: 30.7788: 36.3770: 28 Nov 2022: 1826: 91 DAY BILL: 32.6422: 35.5427: 28 Nov 2022: 1826: 364 DAY BILL: 26.4145: 35.8963: 21 Nov 2022 ... Treasury Bills (T Bills): Definition, Rates & Maturity | Seeking Alpha Coupon rate: The interest rate paid on the bond and is a percentage of the face value. For example, a bond having a coupon rate of 5% and a face value of $1,000 will pay bondholders $50... Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Current Value of Funds Rate Interest Rates for Various Statutory Purposes

Treasury bill coupon rate. Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. 6 Month Treasury Bill Rate - YCharts The 6 month treasury yield reached nearly 16% in 1981, as the Fed was raising its benchmark rates in an effort to curb inflation. 6 Month Treasury Bill Rate is at 4.57%, compared to 4.54% the previous market day and 0.10% last year. This is higher than the long term average of 4.48%. Stats Related Indicators Treasury Yield Curve Quickflows en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

› terms › tTreasury Yield: What It Is and Factors That Affect It May 25, 2022 · Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ... home.treasury.gov › interest-rates › TextViewResource Center | U.S. Department of the Treasury coupon equivalent 8 weeks bank discount coupon equivalent 13 weeks bank discount coupon equivalent 17 weeks bank discount coupon equivalent 26 weeks bank discount coupon equivalent 52 weeks bank discount coupon equivalent 1 mo 2 mo 3 mo 4 mo 20 yr 30 yr; 01/02/2002: n/a : n/a : n/a : 1.71 : 1.74 : n/a : n/a NASDAQ - Datastore NASDAQ - Datastore home.treasury.gov › policy-issues › coronavirusCovid-19 Economic Relief | U.S. Department of the Treasury Latest Programs and Updates Office of Recovery Programs Self-Service Resources The Office of Recovery Programs is providing self-resources to assist recipients of awards from its programs with questions about reporting, technical issues, eligible uses of funds, or other items. View a complete list of available self-service resources. American Rescue Plan Six Month In total, the Treasury ...

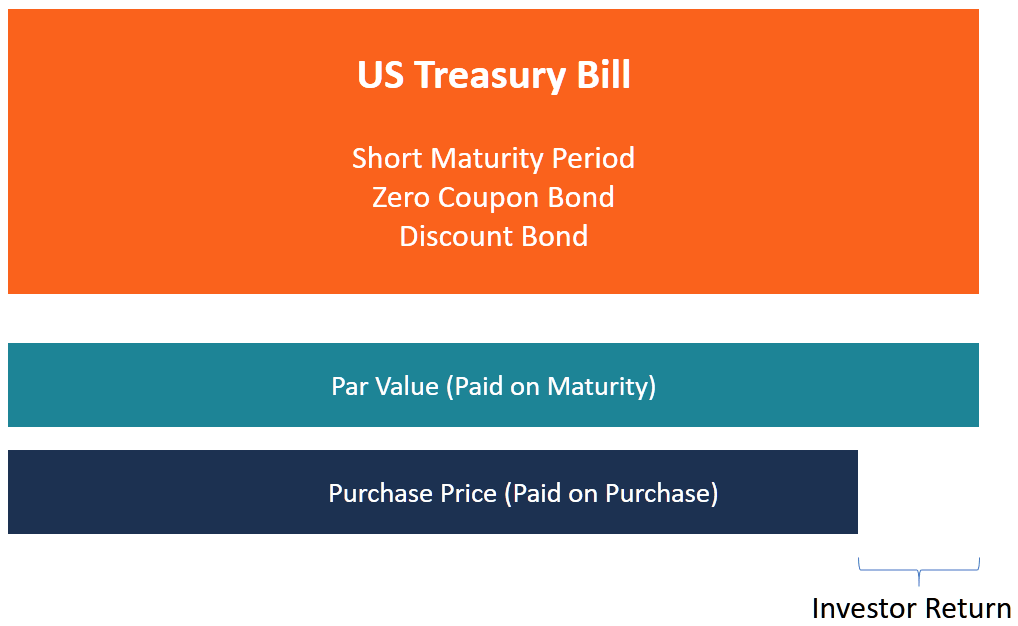

Should You Buy Treasuries? - Forbes With interest rates rising, government bonds have become a lot more attractive for investors searching for a return on cash. The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison ... Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week. Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. newbie question on treasury bills : r/bonds Meaning they don't pay you a coupon twice per year like other treasuries that have a maturity of >1 year. You will get this 3.8% yield because you are going to be paying less than the par value. Meaning, if it's a $1000 tbill for instance, you will be paying $995 or some value less than 1000.

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face value. 9 In other words, it would cost approximately $970 for a $1,000 T-bill. What...

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Coupon Rate 0.000% Maturity Nov 2, 2023 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Spread on 1- and 10-year Treasury yields inverts by almost full...

Community Finance Policy | U.S. Department of the Treasury Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America's Finances. Monthly Treasury Statement.

Treasury Bills — TreasuryDirect If you write to us and want a response, please put your address in your letter (not just on the envelope). Department of the Treasury Bureau of the Fiscal Service Attention: Auctions 3201 Pennsy Drive, Building E Landover, MD 20785 Call Us For general inquiries, please call us at 844-284-2676 (toll free) E-mail Us

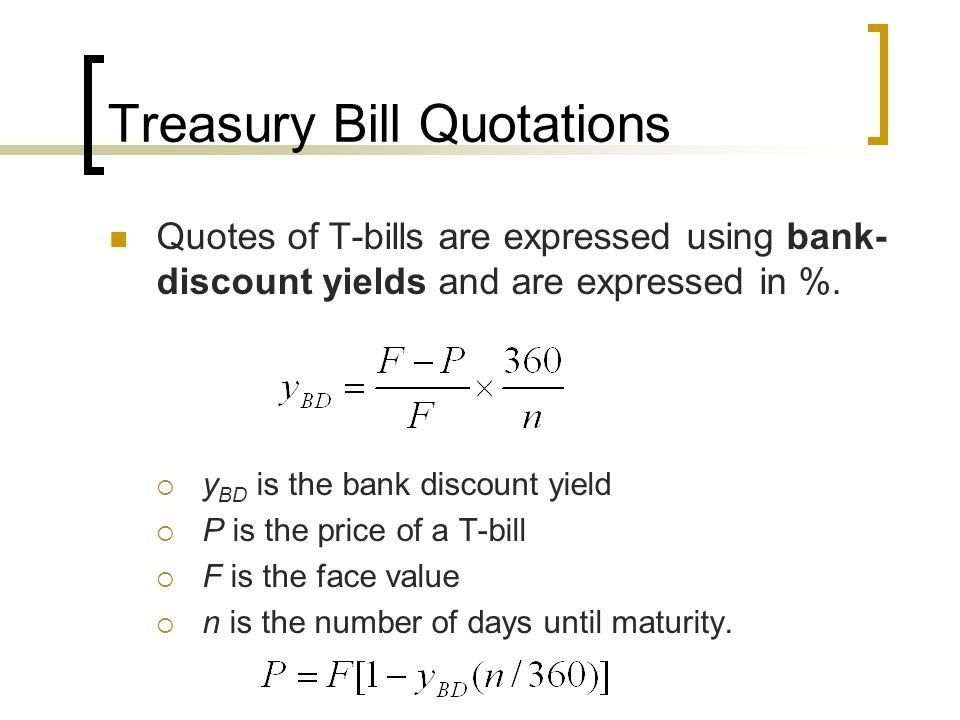

How To Invest In Treasury Bills - Forbes Advisor Since they offer such short maturities, T-Bills don't offer interest payment coupons. Instead, they're called "zero-coupon bonds," meaning that they're sold at a discount and the difference...

Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Treasury Bills. Treasury bills categories into 3 bills as per maturity namely, a) 91 Day b) 182 Day c) 364 Day. Treasury bills are sold out at a discounting price, and it did not pay any interest. Treasury Bills is also called as T-Bills. A treasury bill is only typed instrument which is found in both capital and money market.

US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: Other Value, $: Maturity Period: Other Period: Price paid for the Treasury Bill, $: Results: Total Profit, $: Percentage Return, %:

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction.

How does the U.S. Treasury decide what coupon rate to offer on Treasury ... Answer (1 of 3): The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge pr...

How Often Does The Treasury Bill Rate Change? - Inflation Hedging Currently, Treasury bill rates are hovering around 2% even for the 1 year bill. This can be contrasted with two years ago when the rates were much higher, around 4%, and also very close to current rate levels for the 2-3 and 3-4 year treasuries. In fact, on average Treasury Bill rates have a yield of around 4.5%.

› government › organisationsHM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to...

Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

How to Buy Commission-Free U.S. Treasury Bills A great way to take advantage of rising rates is to buy short-term securities issued by the federal government called Treasury bills, or T-bills for short. A one-year T-bill yielded 4.59 percent on Nov. 10, higher than a 30-year Treasury bond, which checked in at 4.03 percent.

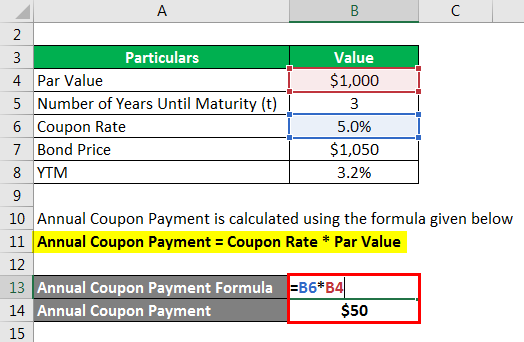

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

› investing › bondTMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Current Value of Funds Rate Interest Rates for Various Statutory Purposes

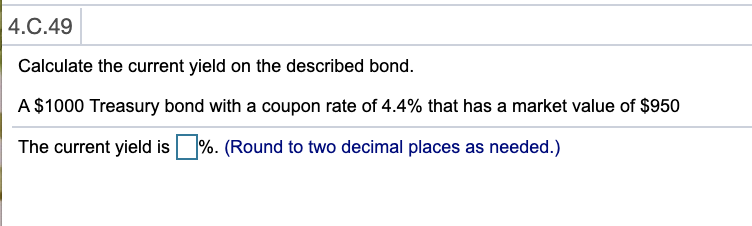

Treasury Bills (T Bills): Definition, Rates & Maturity | Seeking Alpha Coupon rate: The interest rate paid on the bond and is a percentage of the face value. For example, a bond having a coupon rate of 5% and a face value of $1,000 will pay bondholders $50...

Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 28 Nov 2022: 1826: 182 DAY BILL: 30.7788: 36.3770: 28 Nov 2022: 1826: 91 DAY BILL: 32.6422: 35.5427: 28 Nov 2022: 1826: 364 DAY BILL: 26.4145: 35.8963: 21 Nov 2022 ...

:max_bytes(150000):strip_icc()/shutterstock_164681615-5bfc3a9246e0fb00517ff39b.jpg)

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

:max_bytes(150000):strip_icc()/history-t-bill-auction_round1-5ceebe9e5e424997ba77185b0a8fde0a.png)

Post a Comment for "44 treasury bill coupon rate"